This is the third in a new series of Drone Analyst white papers intended to share lessons learned within specific industries. These reports will help you as a business owner in those industries maximize the value that drones can deliver. This year we are building on the analysis we did for the 2016 “Truth About” papers by incorporating real-world

experience gained from businesses and drone pilots operating under the Federal Aviation Administration’s Small Unmanned Aircraft (UAS) Regulations (aka FAA Part 107). As of March 31, 2017, FAA data indicates there are more than 39,000 drone

operators certified under Part 107 and 61,000 commercial drones registered in the U.S.

Introduction

As early as 2014, mining operators and aggregate producers in Australia, Canada, France, and the U.S. were putting drones to the test. And why not? These industries are one of those countries’ most important economic sectors. And they’re growing. In 2016, the consumption of construction aggregates worldwide was estimated at 43.3 billion metric tons (BMT) with a value of $350 billion. Production volume is anticipated to reach 62.9 BMT by 2024. Mining accounts for almost a quarter of Canada’s exports, and is both a major employer and source of royalties and tax revenue. Combined, these two industries have a significant footprint, not just economically in terms of employment

but also environmentally to their host communities. This footprint extends from exploration, to extraction, processing, and shipping. Surveillance, monitoring, maintenance, and oversight in all these areas are monumental tasks, and current approaches to this are both capital and labor intensive.

Back in the early days, visionaries knew that drones could be used for a wide array of activities. Turns out these visionaries have found in the mining and aggregate sectors a frontier for unmanned aerial vehicles, otherwise known as UAVs. In recent years, small drones have helped many firms find cheaper and safer ways to map deposit sites, explore for minerals, and calculate inventory via remote control. A drone, with the relevant sensors and data integration, is an excellent tool for such roles. It seems with the ability to monitor stockpiles, map exploration targets, and track equipment, the usage of drones is vast. It’s no wonder a rising number of software vendors are targeting this space with increasingly useful solutions. And a new generation of drones is delivering more and more functionality. So what have mining operators and aggregate producers learned about what works and what doesn’t? What have the early adopoters learned about operating their drones? And where do we go or what can we expect from here?

LESSON 1

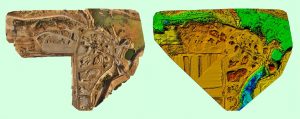

Cost efficiencies are just the start of drone benefits We’ve written about the many ways drones provide efficiencies in The Truth About Drones in Mapping and Surveying. This July 2016 report is a good primer for those who are new to the many technical topics involved with surveying and mapping, such as orthomosaics, photogrammetry, and digitial elevation modeling. Drones and the data from drones offer huge advantages in

every part of the mining and aggregate production lifecycle including exploration, planning/permitting, operations, and reclamation. One of the strongest cases for using UAVs in mining is that it is simply a more cost-effective method than traditional mapping and surveying approaches. Drones are cheaper to operate than manned aircraft, which entail a number of running and maintenance costs. Although there are associated ongoing costs with drones, the bulk of their expense lies in the initial procurement. For more on this, see the ROI section below. Solution provider Sensefly offers a detailed list of the activities where mining and aggregate companies have found value with drones. These include:

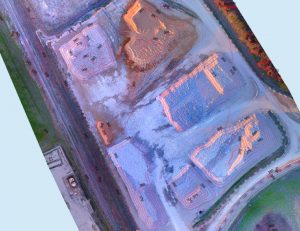

• Pit and dump management

• Communication of daily/weekly plans

• Haul route surface optimizations

• Haul road, dump and pit design

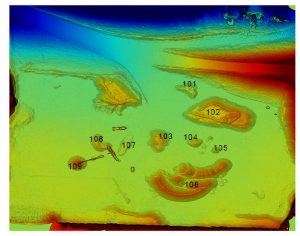

• Up-to-date surfaces for optimised blast designs

• Pre- and post-blast data

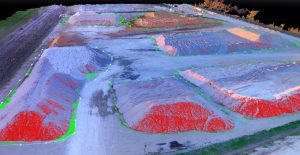

• Stockpile management

• Grade control & exploration planning

• Drainage and water management

• Watershed, drainage basin, and water flow mapping

• Thermal detection of ground water inflows

• Tailing dams management, etc.

• Construction feasibility studies

• Leach pad, dam wall, and platform construction quality

control

• Construction progress monitoring & reporting

• Geophysical & watershed/catchment area modeling

• Land usage reporting• Heritage and environmental management

• Erosion detection

• Vegetation change tracking

• Cadaster surveys

• Property rights definition

• Security, corridor, and boundary surveillance

Another innovative benefit of drone data is its use in mine and pit machinery management. As reported here, Lucky Stone, the U.S’s largest family-owned producer of crushed stone, sand, and gravel, partnered with Airware because of its analytics

tools developed specifically for the mining and aggregate industry. The system allows them to plan drone flights, capture high-quality data, analyze it, and create a survey-grade mine and quarry site map of up to 1,000 acres per day. But the added value is Airware’s software conections with Caterpillar’s machine telematics data. ‘Telematics’ is an industry term describing data about the equipment (what it’s doing) and its location (where is it?). The benefit to Lucky Stone is they can access critical information faster and improve operational efficiencies at quarry sites and make better decisions. ACTION: We recommend you begin assessing drones by using them to produce survey maps and build upon that foundation first. Orthomosaic maps require less workflow and software integration, and are an effective way to make the value case for future business process improvements or software investments such as using drones data to perform stockpile measurements.

Drones and the data from drones offer huge advantages in every part of the mining and aggregate production life cycle including exploration, planning/permitting, operations, and reclamation. One of the strongest cases for using UAVs in mining is that it is simply a more cost-effective method than traditional mapping and surveying approaches.

LESSON 2

Using drones should be part of an overall effort to digitize planning and operations

Research from the McKinsey Global Institute (MGI) on the state of digitization across the U.S. economy finds a large and growing gap between sectors, and between companies within those sectors. The study, which looked at 22 industry sectors, finds the most digititized companies have the highest growth rates of productivity and profit margins. Interestingly, the mining sector was among the laggards. However, this gap underscores not only the challenge of continuously adapting, but also the size of the opportunity still ahead. In fact, the report finds some of the sectors that are currently lagging (like mining and aggregates) could be poised for rapid productivity growth.

But digitization is not simple. It’s important for mining and aggregate organizations to make the transition from traditional methods to technology enabled business processes.

As Infosys points out, the focus areas for that enablement include:

• Safety

• Environmental impact

• Process improvement

• Remote operations

• Exploration and production techniques

• Asset management

• Efficiency

• Mine or opereations automation

• Mergers and aquisitions

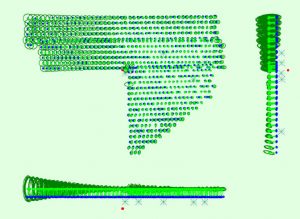

With that in mind, drone data needs to be seen as a digital asset that must be properly managed. In fact, drones provide a tremendous amount of data and you need to be ready to manage those volumes. Some solution providers like Trimble understand this and offer mine information systems. Still, you will need to account for the volume of data. Drones capture large data file sets, with each image requiring 10 Mb or more.

Orthomosaic and point clouds (.LAS files) are typically 1 Gb or more. You will need to account for data transport bottlenecks (up and down) as well as data security and permissions.

Barrick Gold has been using drones since 2012 at several mine sites, for everything from volumetrics, to environmental management, to construction monitoring. Iain Allen, Senior Manager, Digital Mining at Barrick appreciates that drones are a real time saver. The company uses drones to capture data as often as daily, and can collect, process and use that data within hours, a process that took days, or even weeks in the past. But the big lesson he says the company learned is “the more you use them, the more you’ll want to use them,” and with growing use comes a side effect: You are inundated with

data and data management soon becomes an issue. ACTION: When evaluating drone solutions or expanding their use, keep your data processing needs in focus. Know your

business objectives—and ensure your provider does, too. Before signing up with a drone data mapping or imaging service provider, make sure that provider is fully committed to understanding the use case and the industry vertical you serve. Not all do. Some providers have more experience in one industry vs. another. For example, they may promote the functionality to serve mining when in fact their core functionality is based on serving agriculture.

Drone data needs to be seen as a digital asset that must be properly managed. In fact, drones provide a tremendous amount of data, and you need to be ready for managing it

LESSON 3

It pays to do your homework on drone data solutions Flying drones daily to capture data is both beneficial and challenging. Drones and the data from drone data services do not

provide a complete solution, and more likely than not, you’ll need to traverse a learning curve. For example, the firms we talked to had to set up new data integration workflows for their existing ecosystem of software solutions. As mentioned above, not all drone solutions for mining operators and aggregate producers are created equal, so it pays to do a bit of research before committing. There are many factors to consider, from software compatibility to price to technical capabilities such as:

• Can you get all the components—drone, sensor, software, and analytics—from one company?

• Is an internet connection required in order to process data?

• Will the software and analytics integrate well with your existing tools?

Be advised that many solutions are stuck in the “picture fascination” stage. They give you thousands of great looking images, but then it’s up to you to invest time to figure out what’s important and determine what it means to get results. And while it’s great that drones can produce so many good images, there’s just limited value in that. The greater value comes in calculating what’s important (like stockpile volume measurement) and pushing out that information in a consumable way (like an inventory report). We think it’s best to understand that there are three parts to the equation: the drone, the sensor, and the data platform. All three should be be tightly coupled as an end-to-end solution.

ACTION: The research process to find the best data solution can be overwhelming and time consuming, but there is some good news. We’ve done a fair amount of this work already which you can access in 5 Tips for Evaluating Online Drone Data Services. You’ll find a list of most (but not all) major cloud-based drone data service providers that are (mostly) drone agnostic.

LESSON 4

Calculating ROI is worth the effort There is no one-size-fits-all equation for determining the return on investment (ROI) of a drone solution. We believe it is a subjective exercise that’s dependent on your needs and the particular problem you are trying to solve. After all, “ROI” is subject to the way you consume a vendor’s service. Some vendors offer “freemium” pricing strategies in which they provide basic data services free but charge a premium for more advanced features and functionality.

Solution provider Kespry offers a detailed cost savings analysis for measuring stockpiles with their drone system. Whitaker Contracting and Madison Materials used Kespry’s automated drone solution and found that combined activities for measuring the Whitaker stockpiles with traditional methods would cost $37,832 with a six time-per-year frequency. The new annual cost to Whitaker using the Kespry system is 22% less—at

$29,320. Given these efficiencies, Whitaker is now able to measure their stockpiles two times more frequently while spending four times less time overall.

One could argue that, to understand the value of any new technology, you should calculate the “achieved cost savings” or “inventory turnover.” But in most cases, a mining technology is an integrated part of a larger system (for example, the software that controls the auto-steer on a hauler), so it’s more difficultto show cause and effect.

ACTION: Drone-based data can impact outcomes in many ways. We advise drone solution shoppers to look at the range of features and pricing plans in a vendor’s offering. ROI for you will be different from another based on how much of the service

you consume. Once you’ve determined the features and pricing plans, sketch out a long-term ROI impact study that assesses these four areas:

1. Accuracy of surveys and inventory

2. Cost of data acquisition

3. Safety and risk mitigation

4. Timeliness and frequency of reporting

LESSON 5

You need a license to fly a drone for commercial purposes, but it’s not complex In the U.S., there are now laws in place that require you to have a license if you are going to fly a drone for commercial use— and that includes any activity for a mining or aggregrate operation such as measuring stockpiles, mapping sites, or tracking equipment. Beginning August 29, 2016, the small UAS Rule took effect. The rule says operators have to obtain a remote pilot certificate with a small UAS rating. Under this rule—also known as Part 107—the person actually flying the drone must have this certificate or be directly supervised by someone who does. The FAA has published a variety of documents to assist businesses seeking compliance with the new regulation. You can find an article with references to those documents here.

Licensing educates operators on important issues such as airspace, flying within line of sight, and other topics that promote safe flying habits. The good news is that it’s not difficult to obtain that license. The process is outlined by aviation attorney and commercial pilot instructor Jonathan Rupprect here. Additionally, the FAA has published the Remote Pilot — Small Unmanned Aircraft Systems (sUAS) Study Guide to communicate the knowledge areas you need to study to prepare for taking the test to earn a Remote Pilot Certificate.

ACTION: Start studying. Resources abound, like this Part 107 test study guide. This particular guide has the material the FAA suggests you study and also includes essential material they left out. Once you understand what the rules are, make a business plan for operations under Part 107. Go back and skim over the Part 107 Summary and read about Part 107 waivers (COAs) and determine if you need to perform non-107 types of operations such as flying at night or beyond visual line of sight.

What’s next?

Drone manufacturers and Moore’s Law are both hard at work— making things faster, lighter, and cheaper. At Skylogic Research, we are tracking the development of new sensor technology. That technology is progressing rapidly in drones and aerial imaging processing—more rapidly and at lower costs than many ground-based surveying solutions.

One of the most exciting developments for the mining and aggregates industries is explained in a SPAR3D interview with Lewis Graham, the president and CTO of the GeoCue Corporation, which develops a variety of solutions for UAVs, LiDAR, and

point cloud analysis. Graham explains that in many cases the ideal solution is to pair a LiDAR sensor with a camera because “really high-resolution data [say resolutions greater than one meter] can be tough to gather with aerial LiDAR. The ideal scenario is to use imagery for context and LiDAR for the 3D component.” The next giant leap will be focal plane array (FPA) LiDAR, also known as flash LiDAR or solid-state LiDAR—LiDAR on a microchip. Graham predicts, “Within the next three years, FPA LiDAR supplemented with a camera will be the standard kit on a mapping drone.” Keep your eye on this space for more innovations. That’s our look at the valuable business lessons learned since Part 107 went into effect. There are plenty of opportunities, plenty of competition, and plenty of reasons for mining operators and aggregate producers to use drones in every phase of their exploration, extraction, processing, and shipping

processes. Those that do will save time, meet demand, and make more money. More important, they will not get left behind as the mining and aggregate industries continue to digitize.

Interesting post! In this context, allow me to promote an upcoming Remote Sensing Special Issue on “The Use of UAVs in the Raw Material Sector, from Mineral Exploration to Post-Mining Monitoring” (www.mdpi.com/si/8125). Manuscript submissions are welcome until 30 September 2017!

Cheers, Moritz