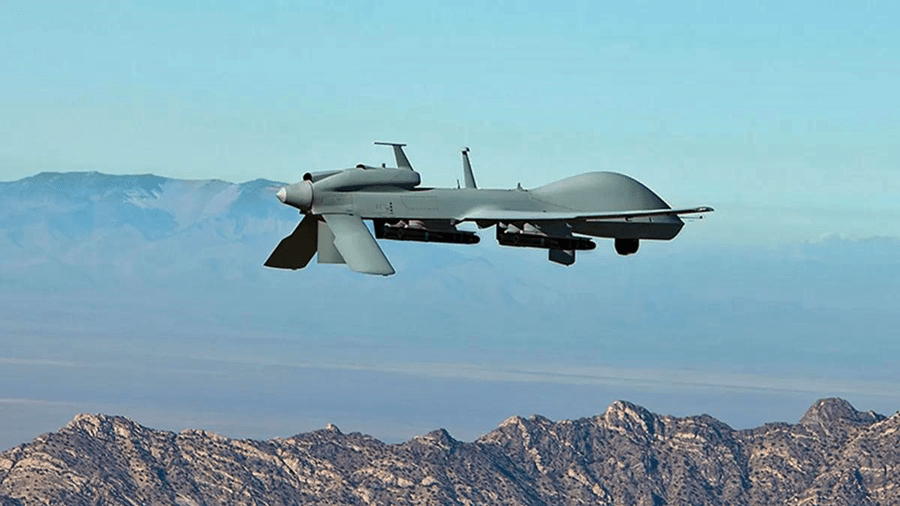

The recreational and commercial use of unmanned aerial vehicles (UAVs) or drones is expected to increase exponentially over the next decade. Operating UAVs is not without its risks. For example, in one published court decision, Philadelphia Indemnity Ins. Co. v. Hollycal Production, Inc., an aerial photographer who was using a camera-mounted UAV to take wedding photos was sued by a wedding guest who was injured when the vehicle struck her in the face, causing her to lose her sight in one eye. In recognition of this risk, there is a growing interest among UAV operators in acquiring insurance coverage. Indeed, many commercial UAV operators find that their customers expect them to have such insurance. This article presents a brief primer on the availability of insurance products that cover UAV accidents.

Coverage under General Liability Policies

Most businesses protect themselves against liability to third parties by purchasing commercial general liability (CGL) insurance. Typically, such policies contain “aircraft, auto or watercraft” exclusions, which most likely preclude coverage for injuries caused by UAVs. One such exclusion, for example, eliminates coverage for “bodily injury or property damage arising out of the ownership, maintenance, use or entrustment to others of any aircraft, auto or watercraft owned or operated by or rented or loaned to any insured.”

This broadly-worded exclusion would appear to bar coverage for most UAV accidents—provided UAVs fall within the definition of “aircraft.” Although most CGL policies do not define “aircraft,” insurers will no doubt argue that the term is commonly understood to include UAVs. Insurers are likely to point to common dictionary definitions, such as the one in the Miriam-Webster dictionary that defines a “drone” as “an unmanned aircraft or ship guided by remote control …” This definition is reinforced by federal statute, which authorizes the Federal Aviation Administration (FAA) to regulate all “aircraft,” and defines that term to mean “any contrivance invented, used or designed to navigate, or fly in the air.”

One of the first judicial opinions interpreting the aircraft exclusion in the context of a UAV accident is the above-referenced Hollycal Production case. There, the insured wedding photographer sought coverage under his CGL policy for the claim of the wedding guest who was injured by an errant camera-carrying UAV. In a declaratory judgment action, the insured’s carrier denied coverage, citing the aircraft exclusion in the policy. The court rejected the insured’s argument that an “aircraft,” unlike a UAV, refers only to a piloted flying vehicle.

Because “aircraft” exclusions are ubiquitous in standard CGL policies, UAV operators may want to ask their insurers to add an “unmanned aircraft” endorsement to their CGL policies. Some insurers will make available, at an increased premium, such an endorsement, which has the effect of exempting “unmanned aircraft” from the aircraft exclusion. Such endorsements typically define an “unmanned aircraft” as an aircraft that is not: (a) designed; (b) manufactured; or (c) modified after manufacture … to be controlled directly by a person from within or on an aircraft.” If the CGL insurer is unwilling to an unmanned aircraft endorsement to the policy, at a reasonable cost, the UAV operator will have to look to other types of insurance policies for coverage.

Coverage under Homeowner’s Insurance

A typical homeowner’s policy provides both first-party property coverage for the homeowner’s property and third-party liability coverage against claims brought against the homeowner by injured third parties. Many homeowners’ policies include some form of aircraft exclusion similar to those found in CGL policies. For example, a typical homeowner’s policy excludes coverage for bodily injury or property damage arising out of the use of an “aircraft,” which is defined as: “any contrivance used or designed for flight, except model or hobby aircraft not used or designed to carry people or cargo.” This definition may be narrow enough to exempt most recreational uses of UAVs from the exclusion. The definition also arguably exempts certain commercial uses of UAVs, such as for aerial photography (assuming a camera is not considered “cargo,” which is a debatable assumption).

Most homeowners’ policies also exclude coverage for claims arising out of or in connection with a “business” engaged in by the insured. “Business” is typically defined as “a trade, profession or occupation engaged in on a full-time, part-time or occasional basis.” Accordingly, even if a camera-carrying UAV is not considered an “aircraft” subject to the aircraft exclusion, accidents that occur while the vehicle is being used for commercial purposes would not be covered. Given these limitations, the average homeowner’s policy most likely excludes liability coverage for all but a narrow category of UAVs: those that do not carry cargo and are only used for recreational purposes.

UAV Insurance

Given the exclusions in most CGL and homeowners’ policies, commercial UAV operators may want to purchase some form of stand-alone UAV insurance, which is now offered by a number of carriers in a variety of forms. There are two basic options: period coverage and on-demand coverage.

Period coverage for UAVs is similar to auto insurance. It is the type of coverage preferred by operators of large commercial drones—which include between five and ten percent of UAVs currently in operation. The period over which the policy applies is usually one year, although lesser and greater policy periods are also available. The coverage must often be purchased through a broker and covers the operation of a specified category or categories of UAV by the insured operator. The policy covers third-party property damage and bodily injury accidentally caused by the UAV. It also usually covers invasion-of-privacy claims, which can be useful where camera-bearing UAVs are flown in populated areas. Some insureds combine this liability coverage with “hull” coverage, which is similar to collision insurance in auto policies in that it covers damage to the vehicle itself. Insureds can also purchase coverage extensions to insure the UAV’s payload, such as a high-priced sensor that can often cost more than the UAV.

The application process for period UAV coverage can be onerous. Insureds will be often be asked by the carriers to disclose how many hours of flight time they have logged, whether they are FAA-licensed UAV pilots, whether they keep maintenance logs, and whether they own or lease their UAV. Their answers to these questions will affect the premiums charged and determine whether the insurer will, in fact, cover the risk.

A less onerous and less costly alternative to period coverage is on-demand coverage, which is becoming increasingly popular among operators of commercial UAVs. Variations of this type of coverage can be purchased by the hour or the day and typically apply to the operation of the UAV in a specified geographical area. Several insurers offer this coverage at very affordable prices.

To illustrate how on-demand coverage works, assume an aerial photography company is hired to take overhead photos of an outdoor festival. Rather than acquire period coverage, the company can simply go on line and purchase a stand-alone policy that covers a single day only—the day of the festival. No broker is involved. Applying for this coverage is simple and straight forward. It can consist of little more than defining the geographical area over which the UAV will fly (e.g. a one-half mile radius around a specified set of coordinates), the date the coverage is desired, and the number of hours over which the coverage will apply.

As long as the UAV weights less than 50 pounds, the cost of on-demand coverage usually is independent of the type of UAV being covered. A million dollars of coverage can be purchased for as low as $10 per hour. The price is commensurate with the risk involved, which is largely a function of the environment over which the drone will operate. For example, if the UAV will be flying over a busy highway, the premium might be a little higher. This type of “on-demand” or “event” coverage is ideal for start-ups that are looking to contain their costs. Unlike many period policies, on-demand UAV coverage can be purchased by operators who do not have government-approved licenses.

Bottom Line

Owners and operators of UAVs would do well to consider UAV insurance. This will usually mean purchasing stand-alone UAV coverage, unless the insured can persuade his CGL carrier to modify the aircraft exclusion to exempt unmanned aircraft. On demand coverage is a low-cost, low-hassle option that may be right for owners/operators of smaller UAVs intended for commercial use.–By Thomas Bick